What are marketing metrics and why do they need a business

I would like the company to just bring money, and someone else would understand all these reports. But your growth and success directly depend on them.

Together with Alena Artemyeva, director of analytics at Rabota.ru and curator of the Data-Based Decision-Making course, we analyzed key marketing metrics. They will help you understand how your business is doing.

CAC (customer acquisition cost) - an indicator of customer analytics

What for? It allows you to estimate the cost of attracting one new client.

How to count? It is calculated as the ratio of marketing costs to the number of new customers.

CAC = MCC ÷ CA

MCC: Total marketing campaign costs related to the acquisition

CA: Total customers acquired

Nuances: when calculating, it is important to take into account that the denominator should be exactly new customers who made their first order in the reporting period. All others are not new clients. Someone could simply register, leave contacts or promise to think. They can be taken into account in other metrics - for example, cost per lead or conversion in the registration form.

RR (Retention Rate) - customer return rate for repeat purchase

Why? It shows the percentage of customers who, after making a purchase, returned for the next one.

How to count? It is calculated as the ratio of the number of customers with a repeat purchase to the number of customers with a previous purchase.

Nuances: for this coefficient, the numerator and denominator must include customers who made a purchase in the same period. Then the RR indicator will allow you to see how attractive your product, product, or service is to customers, and how willing they are to return to you again.

Important! The higher the RR, the more you can earn from a client over a long time frame. Another special attention should be paid to RR for new customers who have made their first purchase and are thinking about a second one. This is important because it is after the first purchase that the majority of customers churn.

ChR (Churn Rate) — churn rate

Why? It is directly related to the RR indicator and shows the number of people who did not want to make the next purchase.

How to count? Calculated as 1−RR. Or - as the ratio of the number of customers who did not make the next purchase to the number of customers in the cohort with the previous purchase.

Nuances: the higher the CTR, the lower the RR. And the less often customers will come back to you for repeat purchases. And therefore, the less profit you will receive from your customers over a long period.

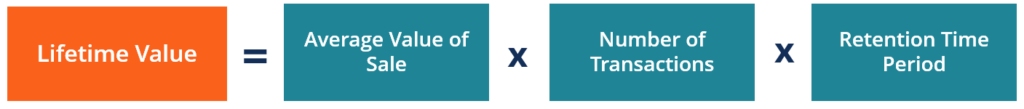

LTV (Life Time Value) - "life value of the client"

Why? This is an indicator that characterizes the total amount of money that you can potentially receive from each new client. At the same time, it must be borne in mind that the client can make not only the first order but also a certain number of subsequent ones.

How to count? There are many ways to calculate LTV. The simplest is to multiply the average check by the percentage of marginality and by the number of potential customer orders. You can also divide the profit from one client for some time by the churn rate (ChR) beyond this period.

Nuances: LTV is not suitable for all types of businesses, but only for those where repeat sales and a relatively high frequency of purchases are provided. For example, if you are selling apartments, it makes no sense for you to calculate LTV since the probability of buying more than one apartment from a family is minimal.

The LTV indicator is important when forming a business plan for startups when you need to understand how potential future customers will be converted into repeat sales. It allows you to justify spending your marketing budget, especially when it comes to expensive channels. Because if you calculate only the profit from each first order of the client and correlate it with CAC, then the finances will most likely not converge, and it will seem that marketing is wasting money.

Eventually

The higher the RR, the higher your LTV, and the better your marketing spend will pay off.

The optimal ratio of LTV to CAC is three to one. Since the cash flows that customers bring to you over their entire lives are greatly stretched over time. Also, a hundred rubles received now is not equal to a hundred rubles received in three years, due to inflation.

In addition, the company is interested in making a profit. Therefore, if this ratio is not fulfilled for you, you should think about how to optimize it.

If you feel that a competent guide to the world of metrics and analytics would not hurt you, come to the Data-Based Decision Making intensive. After training, you will have templates for building unit economics and P&L models and the confidence to apply new knowledge to your projects.

Comments

Post a Comment